Bowling Green is growing fast. New warehouses, factories, and shipping centers keep opening across the area. Because of this growth, more commercial land deals now move quickly. However, faster deals also bring more risk. Buyers and lenders no longer feel safe using only old maps or simple land records. That is why more industrial property deals now require an alta land survey before closing. This is not just extra paperwork. Instead, it helps protect the deal before money changes hands and construction begins.

Industrial growth changes how land gets bought, checked, financed, and built on. When parcels get bigger and land history gets messy, clear proof becomes more important than speed alone.

Industrial Expansion Creates More Complex Land Deals

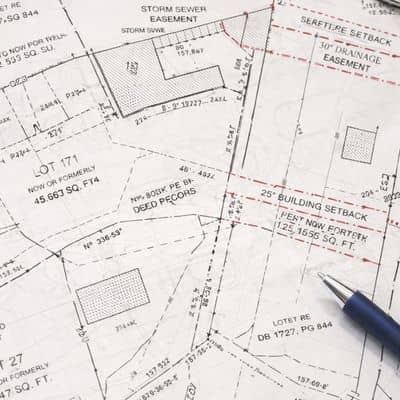

Industrial land is rarely simple. Many sites include joined parcels, shared entrances, and long utility histories. A property may look open and ready to build on, yet legal limits may tell a different story.

For example, some large sites include old service paths, shared access rights, or utility lines that cross the build area. In other cases, parcel records from past sales do not match each other.

Because of this, buyers cannot trust looks alone. They need measured proof. An alta land survey shows how the land sits both on paper and on the ground. That matters when building size, truck access, and loading areas depend on exact land rights.

Purchase Contracts Now Ask for Deeper Survey Detail

Industrial purchase contracts look different today. Most now include stronger land-check rules. Lenders and investors want more proof before they release funds.

As a result, many contracts now require added survey detail. They may ask for clear access labels, plotted easements, or setback checks. Some also require survey certification to several parties.

This change comes from risk control, not red tape. Industrial projects cost more and last longer. Therefore, every group involved wants better land proof before they approve the deal.

An alta land survey meets this need because it follows known commercial survey standards.

Industrial Sites Show More Record vs Ground Conflicts

Another reason demand has grown is the gap between records and reality. Industrial land changes owners and uses more often than small sites. Over time, records and ground use drift apart.

Survey crews often find fences off line, access paths never recorded, or old easements still active. These problems usually stay hidden until a deep survey review begins.

When lenders or title teams find these conflicts late, closing slows down. Therefore, many buyers now order an alta land survey early so they can fix problems sooner.

Fixing issues early costs less and causes less stress.

Industrial Deals Bring More Survey Revisions

Industrial ALTA projects also see more update requests before final approval. This happens because more people review the survey during closing.

For instance, lenders may ask for added wording. Title teams may want clearer easement notes. Attorneys may request better access labels. Investors may want more site counts or parcel notes.

Each change helps the deal. However, each change also takes time. Because of this, early survey start dates help protect the closing schedule. When buyers wait too long, updates pile up near the deadline.

An alta land survey works best when teams allow enough time for review and updates.

Growth Areas Put Pressure on Survey Schedules

Industrial growth affects survey timing too. Large sites need more field work, more record research, and more drafting time. At the same time, growth areas create more survey requests all at once.

Because of that, survey firms often run full schedules during growth periods. Also, ALTA surveys require coordination between buyers, lenders, title companies, and surveyors.

So timing matters more now than before. Buyers who start early gain more flexibility. Buyers who delay often face tight timelines and fewer options.

In busy markets, early planning wins.

Industrial Buyers Benefit From Early Survey Clarity

Industrial buyers now compete in a tighter market. Sites sell faster, and financing checks run deeper. Because of this, clear land proof gives buyers an edge.

An alta land survey gives everyone the same trusted map. It helps lenders, title teams, and planners work from one clear layout. That shared view lowers redesign risk and reduces approval problems.

Buyers who understand land limits early negotiate better and plan smarter. They also avoid last-minute surprises that change cost or design.

Growth Rewards Speed — But Certainty Closes Deals

Bowling Green’s industrial growth brings strong chances for investors and builders. New projects support jobs and local business. Still, fast growth also raises the need for clear land proof.

Modern industrial deals depend on verified facts, not guesses.

An alta land survey provides that proof right where it matters — at the point where land, money, and plans meet. When buyers confirm land facts early, deals move forward with fewer problems and more confidence.

In a fast market, certainty does not slow deals down. It helps close them.