If you’ve been confused about mortgage surveys, you’re not alone. A recent Reddit post went viral after a homeowner asked a simple question: Do mortgage surveys expire? Within hours, hundreds of people jumped in. Some insisted surveys never expire. Others said their lender rejected anything older than 30 days. Many shared stories about closing delays, surprise fees, and last-minute stress.

The truth sits somewhere in the middle. And once you understand how mortgage surveys really work, the confusion clears up fast.

Why So Many People Get Mixed Answers

At first, it sounds logical. If property lines don’t move, then why would a mortgage survey ever expire? The land stays in place, and boundaries remain the same. So naturally, people assume a survey should stay valid forever.

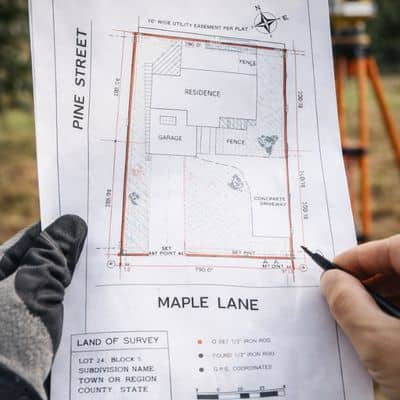

However, mortgage surveys do much more than show where your property begins and ends. They also capture everything sitting on that land at the moment the survey happens. This includes buildings, fences, driveways, patios, sheds, and anything else that could affect value, access, or legal rights.

Because properties change over time, lenders focus on what exists right now, not what existed months or years ago. That’s where the confusion starts.

What a Mortgage Survey Really Shows

A mortgage survey creates a snapshot of your property as it exists today. It documents visible structures, access points, and any issues that could affect ownership or financing. Lenders rely on this information to confirm that nothing interferes with legal boundaries, easements, or building rules.

Even small updates can matter. A fence added in the wrong spot, a deck built too close to the line, or a driveway expanded across an easement can all trigger red flags. Because of this, lenders want to see current conditions before finalizing a loan.

That’s why mortgage surveys play such an important role during buying, selling, and refinancing.

So… Do Mortgage Surveys Expire?

Technically, mortgage surveys do not expire. A survey remains a legal record of how a property looked at the time it was performed. However, lenders usually require mortgage surveys to be recent, often within 30 to 90 days.

This requirement exists for one simple reason: risk.

From a lender’s point of view, outdated information creates uncertainty. If a survey is old, there’s no way to confirm whether new structures appeared, boundaries were crossed, or access routes changed. Even if nothing seems different, lenders cannot assume that.

So while a mortgage survey never truly expires, its usefulness fades quickly. That’s why lenders push for updated surveys before closing.

Why Lenders Reject Older Mortgage Surveys

Most rejections happen because properties change faster than people expect. Over just a few months, homeowners often add features that never show up on older surveys. A new fence, patio, shed, or driveway adjustment may seem minor, yet these changes can create legal and financial risk.

Lenders also worry about hidden encroachments. A neighbor might install a fence that crosses onto your property. A driveway might extend into an easement. These problems don’t always show up in casual walk-throughs, yet they matter greatly when it comes to financing.

Because of this, lenders prefer surveys that reflect current property conditions. It protects them, and it protects homeowners too.

Why This Frustrates So Many Homeowners

The viral Reddit thread revealed a common theme: people feel blindsided.

Many homeowners believe they already paid for a survey, so being asked to order another one feels unnecessary and unfair. Others feel frustrated when closing dates get pushed back while waiting for updated drawings. Some even suspect lenders of adding extra requirements for profit.

In reality, most of these requests come from strict underwriting rules. Lenders operate under heavy regulation, and updated surveys help them meet those standards. Even so, that explanation rarely removes the frustration.

How Timing Impacts Your Closing

Mortgage surveys often sit on the critical path of a real estate transaction. That means delays with surveying can delay everything else. Title work, underwriting approvals, and final loan documents often wait on survey completion.

Because of this, many closings stall when surveys get ordered late. Stress rises, deadlines slip, and everyone scrambles. However, when surveys get scheduled early, the entire transaction flows much smoother.

This timing difference explains why experienced buyers, agents, and lenders always push to handle surveys early in the process.

How to Reduce Stress and Extra Costs

The best way to avoid unnecessary delays starts with communication. Asking your lender about survey requirements early allows you to plan correctly. When you know how recent your mortgage survey must be, you can order it at the right time.

Clear communication with your surveyor also helps. Sharing details about recent improvements ensures the survey reflects your property accurately. That reduces the chance of revisions or redraws, which often add cost and time.

Finally, working with a local survey company makes the entire process easier. Local professionals understand regional zoning rules, recording standards, and lender expectations. That experience helps avoid mistakes that cause rejections.

Why Local Survey Companies Make a Difference

Local surveyors know how properties in your area are developed, subdivided, and regulated. They understand common boundary issues, drainage concerns, and permitting rules. This knowledge allows them to prepare mortgage surveys that meet lender requirements with fewer revisions.

Local firms also communicate more easily with nearby lenders, attorneys, and title companies. That connection often speeds up approvals and keeps transactions moving forward.

For homeowners, that means less stress, fewer surprises, and smoother closings.

The Bottom Line on Mortgage Surveys

Mortgage surveys don’t technically expire. However, lenders usually require them to be recent because property conditions change. That’s why older surveys often get rejected, even when nothing seems different.

Understanding this difference helps remove confusion and frustration. When you plan ahead, ask the right questions, and work with experienced local professionals, the mortgage survey process becomes far easier.

If you’re searching for dependable survey companies near you, choosing a licensed local land surveyor helps ensure your mortgage survey meets lender standards the first time — saving you time, money, and closing delays.